Former art and design instructor Christine Bartsch holds an MFA in creative writing from Spalding University. Launching her writing career in 2007, Christine has crafted interior design content for companies including USA Today and Houzz.

Grief tends to linger near the surface when you’re the one in charge of a recently-deceased family member’s estate through the lengthy probate process. While this may tempt you to rush through the probate timeline, doing so is impractical and often impossible.

Work With a Top Probate Agent

Top-performing agents sell homes faster and for more money than average agents. When selling a house in probate, maximizing the home sale can best serve the estate’s interests.

The probate timeline takes a while to complete because its designed to prevent the executor from making hasty decisions rooted in grief. It also allows plenty of time for notifying all beneficiaries and creditors, as well as completing all final financial transactions before the estate is dissolved.

Outside factors will also impact the probate timeline and how long the probate process takes. For example, in some states overburdened probate courts are backed up, resulting in court date delays of weeks or months. If the estate includes property to be sold, the probate real estate sale process can lengthen the proceedings significantly.

A clear understanding of how the basic probate timeline works can ease the stress of this challenging, and often lengthy process.

Anywhere from three months to several years. That’s a rather wide window—largely because each probate case is unique.

Probate laws in the state where the estate property resides also play a major role in the length of the probate timeline. For example, in some states, the value of the estate determines how long the process will take.

Thankfully, some states have taken steps to refine and simplify the probate process. Sixteen states have adopted the American Bar Association-approved Uniform Probate Code to simplify probate proceedings.

Other states have devised their own means of streamlining the probate process, such as in California where they’ve enacted the Independent Administration of Estates Act (IAEA).

According to Sacramento-based probate attorney John Palley, who has been awarded Martindale-Hubbell’s prestigious “AV” peer review rating:

“The main thing we’re trying to do is gather all of the assets, so the house, the bank accounts, the cars. Next is determining the creditors and what all the liabilities are and making sure that all of the taxes get paid. The last major step in probate is making sure that the right heirs have been ascertained.”

While there are National Probate Court Standards, there is no universal timeline that applies to all 50 states because the laws and procedures vary by state.

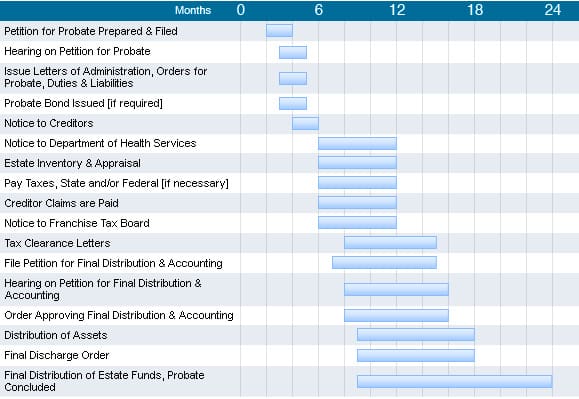

The easiest way to understand the probate timeline is to look at all of the major steps most probate cases will require and how long each one is estimated to take. We’ll also take a look at when and how to handle the parties involved in the probate process.

Even if all beneficiaries of the decedent’s will attended the funeral and are aware that you’ll be handling the estate, this fact alone isn’t enough for the probate courts. You’ll need to issue a formal notice of probate to all interested persons, which means all beneficiaries and heirs.

Depending upon local laws, you may have up to three months to notify interested parties after your probate petition is accepted by the courts at your first hearing. However, it’s best to get this done prior to your hearing so that you can obtain a waiver of process and consent to probate from all interested parties.

This waiver and consent tells the court that all beneficiaries acknowledge the validity of the will (if there is one) and are willing to have you act as the executor or personal representative With this consent, they are waiving their rights to contest the will or any legal action you may take in regards to the estate.

Having these waivers at your first hearing increases your chances of being awarded the rights of independent administration—which means the court will be less involved in your handling of estate assets.

This process can take as little as a few days if you have current contact information for all beneficiaries and they are willing to sign the waivers. If you need to search for the beneficiaries or if any parties decide to contest the will, this can take one to two months or longer.

Unless the value of the estate is extremely low and contains no property, you will likely need a probate attorney to file the petition to probate the decedent’s estate.

Once this petition is filed, you’ll receive a court date for your first hearing—which will be set several weeks or months out based on the court’s availability. How long this step takes depends largely upon how soon you can get a court date scheduled.

Prior to this hearing, you are not officially the executor or personal representative of the decedent’s estate, so you cannot legally conduct estate business, such as signing a listing agreement with a real estate agent for estate property. However, you can bring on a probate experienced real estate agent to help you prep for the sale of the property by assessing the properties value, running comparables in the neighborhood, determining the home’s value, connecting with cleaning services, contractors, and other vendors.

Provided all of your petition paperwork is in order, the probate court judge will name you as the personal representative of the decedent’s estate by issuing letters of administration if there is no will, or letters of testamentary if there is a will.

At this time, the judge will also decide to grant you either the rights of independent administration or dependent administration.

Any debts owed by the decedent prior to death (such as credit card bills and mortgage payments) need to be paid out of the balance of the estate. These funds come from estate assets such as existing bank accounts, sold off stocks, life insurance benefits and the proceeds from the probate property sale.

In order to determine any debts owed, you’ll need to issue a formal notice to creditors which, depending upon state law, may need to be published in a local newspaper for a set period of time.

You should also go through the decedent’s financial paperwork for any bills and

request a credit report for decedent to identify potential creditors. This creates a paper trail for the courts to show you made appropriate efforts to identify any potential debt claims against the estate.

Once you’ve given all creditors notice, they have a set period of time in which to make a debt claim.

This window of time varies from state to state. In California, Palley explains, “The probate process, from that first court date when the letters are issued, is four months before you can legally file your final petition in California.”

Other states, like Texas, allow creditors six months to file debt claims against the decedent’s estate—which means you cannot file your final petition to close probate and dissolve the estate until those six months are up.

While you’re sorting through financial records for creditors, you should also be on the look out for tax documents. As part of closing the estate, you’ll need to file the final individual tax returns for the decedent and you may also have to file estate or gift taxes. All tax transactions must be completed before probate can close.

One major task that needs to be done during probate is the inventory of assets. For this you’ll need the official probate forms from your state as this document will become a part of the official records of the estate that must be filed with the final petition at the close of probate.

It’s important to note that some estate assets are not subject to probate, so check with your probate attorney as you compile your inventory.

This inventory helps the probate court determine the cash value of the estate, based in part on the date of death value or the alternative valuation date which is within six months after the date of death.

Generally, a professional appraisal is needed in order to determine these valuations, especially for real estate.

This step can take anywhere from a few weeks to several months, depending upon the size of the estate and how long it takes to arrange the asset appraisals.

When the estate contains real estate you intend to sell during probate, the procedures of the probate sale depends upon whether you were awarded independent or dependent administration rights.

If you’ve been granted independent administration rights, there is little to no court oversight during the sale of probate property. The sale proceeds much like a traditional real estate sale; however, there are differences in procedure, contracts and disclosures. This is why having a probate experienced real estate agent can be extremely helpful.

A personal representative with independent administration rights is permitted to list, accept an offer and close on the property sale without approval from the probate court. All of the probate sale paperwork simply needs to be included in the final accounting paperwork.

These probate sales follow the timeline of a traditional real estate sale, which currently takes take an average of three weeks to receive and accept an offer and an average 47-day escrow period.

If you’ve only been granted dependent administration rights, the probate sale process is significantly different and longer. While you will be able to list the home and even accept an offer, you cannot complete the sale on your own.

The probate court will need to approve and oversee the sale with a court confirmation hearing. At the hearing, your probate attorney will present the offer you’ve accepted to the court—however, the court will not immediately accept this offer.

Instead, the probate judge will open the overbid process, which proceeds similar to an auction. Any interested buyers may then put in a bid for the property, starting at a percentage above the presented offer—as set by the court per state laws. The best offer is accepted and confirmed by the court during this hearing.

A probate sale with court confirmation adds another several weeks or months to the timeline. Just as in a traditional sale, receiving and accepting an offer takes several weeks. Once you’ve accepted one, you can schedule for the court confirmation hearing—often several weeks or months out.

In some states, you may even be required to remarket the property at the accepted offer price for 30 to 45 days before you can have your court confirmation hearing. All told, these extra steps add anywhere from a month or more to the timeline.

Whether yours is a simple probate sale or a more complex one requiring court confirmation, Palley advises hiring an experienced probate real estate agent:

“It’s nicer if the agent has significant probate experience so that they know the differences between a traditional sale and a probate sale. Finding an agent with accreditation or who can show that they’ve done a number of probate sales would definitely be advisable.”

While you are selling the property and settling account debts, you need to keep track of all the paperwork generated while conducting business transactions on behalf of the decedent’s estate.

All of this documentation must be compiled and presented to the probate court for review. This process is generally known as the final accounting.

Although the final accounting forms and requirements vary from state to state, these forms basically present the financial information of the estate. This includes the initial cash value of the estate, the debts, fees and taxes paid, and deposits received—such as the proceeds from the property sale.

Along with the final accounting forms, you’ll also submit other documentation including your asset inventory, appraisals, and the probate sale contracts. You should also include any signed receipts for any tangible property you’ve distributed to beneficiaries, such as family heirlooms bequeathed in the will.

Once assured that all the paperwork is in order, your attorney will file another petition for a final hearing to distribute remaining funds and close the estate.

Connect with a Top Agent

Selling a home can be a difficult process under the best of circumstances. Partnering with a top agent experienced in probate can help when selling a home after a death in the family.

During the probate process, you may distribute some assets, like tangible personal property. However, in most states you are required to wait to distribute financial assets—such as proceeds from the property sale—until the final probate hearing.

This is to allow the probate court to review your final accounting to ensure that every effort was made to identify creditors and pay the decedent’s debts before the estate is dissolved.

If a credible debt claim is made against the estate, the court can hold the executor personally liable for failing to properly notify the creditor or distributing funds to beneficiaries before all debts were paid.

Like the initial petition to probate, the number of weeks or months between filing your petition and that final hearing largely depends upon the probate court’s availability.

Provided all of your documentation checks out, the probate judge will rule for probate to be closed and the estate dissolved. At that time, you will use the estate funds from the estate to pay final expenses, including court costs and attorney’s fees. The remaining balance is then distributed to the beneficiaries and your duties and responsibilities as the personal representative are concluded.

The timeline of the probate process is definitely intimidating when you look at how long each step can take. However, many of these steps—such as sending the notice to creditors and the probate property sale—can happen simultaneously. With the help of a top-notch attorney and an experienced probate real estate agent, you can considerably shorten the probate timeline.

Article Image Source: (Jiyeon Park / Unsplash)

At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.